Labour’s pensions review is a great opportunity for government to tackle some of the thornier problems facing the future of private pension saving, helping today’s workers avoid becoming tomorrow’s poverty-stricken pensioners.

We hear all the time about how tough life can be for pensioners on lower incomes, and we at Age UK are determined to do all we can to help future cohorts avoid the same fate – prevention is better than cure. It’s very welcome the government is on the same page.

The introduction of automatic enrolment into workplace pension saving over the last ten years has transformed the landscape. Millions more people are now saving for their retirement, and it’s generally regarded as one of the great political successes of the 21st century. But there are still some groups who either aren’t saving or aren’t saving enough, and it’s crucial that action is taken to help.

Read more:

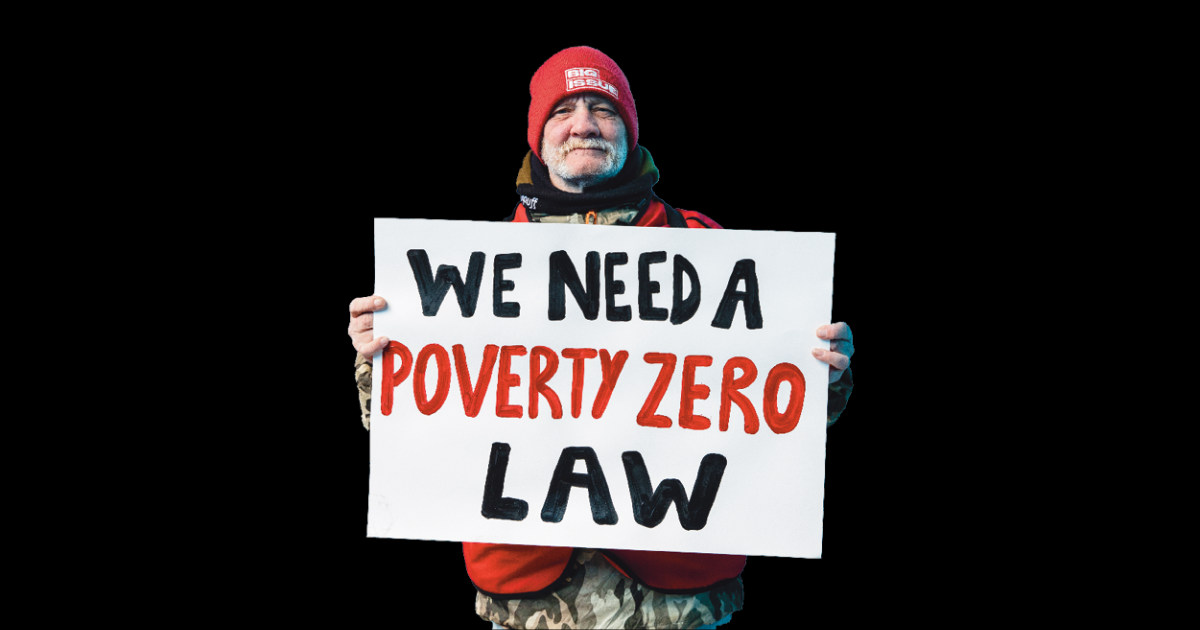

- Homeless people were given free cash to buy what they want – here’s what they spent their money on

- It’s time for the government to scrap the two-child benefit cap – we can’t afford not to

- The importance of PIP for disabled people has never been clearer

Several million self-employed people, who for obvious reasons can’t be auto-enrolled, aren’t saving anything. Others – including those on low incomes, often women working multiple jobs – don’t earn enough in one job to meet the qualifying threshold so also aren’t saving. The government reckons that broadly speaking it’s about 50-50 in terms of savers versus non-savers among the working age population.

It also thinks that by 2050, retirees will on average by £800 a year worse off than the current pensioner cohort. This is largely due to the decline of final salary pensions, which these days are largely a luxury only some public sector workers enjoy.